Third Pillar

The question whether to open a third-pillar (3A) account came soon after I started working full-time. But the number of available options made this seemingly simple decision quite intimidating. And I must admit that I made mistakes along the way until I found the optimal solution for myself. But in retrospect, I've realised that these mistakes were quite harmless, and that changing strategy and optimising along the way are possible. There are actually a lot of resources comparing the best third-pillar solutions in Switzerland. However, I couldn't find a comparison between saving into a third-pillar and normal account. When using a third-pillar, you save income tax now and pay capital tax later before retirement, and vice versa for a normal account, so there's no clear answer. I hope that by sharing my research and experience, it can help you in clearing up this question and finding your optimal third-pillar solution.

Before we go further, it's important to know what a third-pillar account exactly is. The simple definition of a third-pillar account is:

Breaking this down:

- Voluntary: unlike the mandatory first and second pillars, opening a third-pillar account is really up to you

- Tax-deductible: the yearly third-pillar contribution can be fully deducted from your income tax

- Retirement-bound: savings cannot be withdrawn until 5 years before retirement with some exceptions (property purchase, move abroad, etc.)

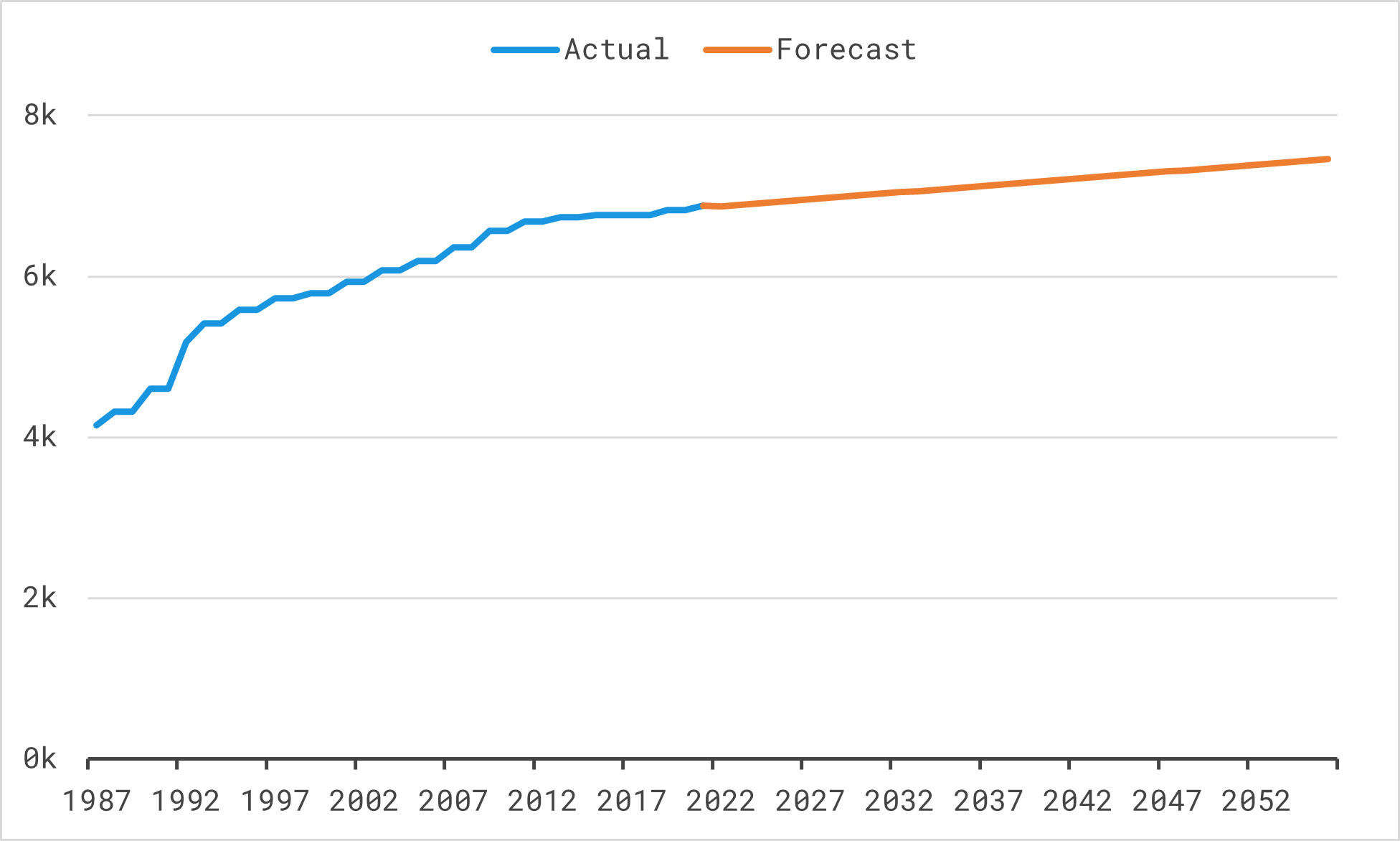

The third-pillar has actually existed since 1987, and the maximum yearly contribution has increased over the years. Using the historical data, I've calculated a simple forecast for the next 35 years (which is when I'll retire assuming that the retirement age is not increased, which it probably will). The change in contribution amount seems to have flattened out in the last 10 years, that's the reason why I only use the latest values to create the forecast to avoid overestimating the contribution that can be made.

There are many third-pillar products out there. I'm going to ignore the third-pillar products from insurance companies, which is only attractive if you need additional insurance coverage. If you don't, the products from banks or neo-banks are cheaper because your contribution is not deducted to pay the insurance premium. The offerings from banks can be grouped into these two categories:

- Savings account: the assets are kept as cash

- Investment account: the assets are invested

There is also a range of brokerage account types offering a different mix of products (stocks, bonds, real-estate, cash, etc.). Putting your contribution into an brokerage account gives you the possibility of realising greater returns compared to the very low interest rate of the savings account which is currently around 0.2%. For the calculation later, I assume a return of 5% for the brokerage account, which is rather conservative when compared with historical data. However, you should bear in mind that you carry the downside-risk should the value of your chosen investment product falls. But over the long-term, you should see the value of your investment grow, and the fact that you can't withdraw your money until close to retirement actually protects you from panic selling.

An important thing to do is to split your third-pillar assets into at least 5 separate accounts over time, because you can neither withdraw only part of a third-pillar account nor transfer money from one third-pillar account to another. By splitting your assets into multiple accounts, you would be able to withdraw one account for each of the five years prior to retirement. This is crucial since you would need to pay capital tax on the withdrawal. These taxes are progressive which means your tax rate would be lower by withdrawing your third pillar accounts at different times.

My first third-pillar account was a savings account with the bank where I have my private account, because I didn't think there was any big difference between the third-pillar providers and I wanted to keep things simple. But then I realised that I was foregoing the possibility of earning returns from investing by choosing a savings account. Then I decided to switch to an brokerage account, but the products offered by my bank had very expensive management fees, which led me to open an brokerage account at another bank and moving my assets there. A few months later, after learning more about personal finance, I decided that I should invest fully in stocks rather than in a mixed product (of stocks, bonds, etc.) since my investment horizon is still long. To my disappointment, the second bank didn't offer a product with 100% stock exposure, which is when I decided to open an account with a neo-bank and move my assets again there, where it has been ever since. This all might seem complicated and I wished that I didn't make these mistakes. However, it's not as bad as it seems, you just lose a few hours filling and sending forms to banks.

To better show the effect of a third-pillar account, I will calculate an example for a hypothetical person called John with 90k in gross yearly income living in Zurich city. After making the typical deductions, his net taxable income comes down to roughly 70k. What's important in the calculation of income tax savings is the marginal income tax rate at this income level, which is given in the table below:

| Marginal Income Tax Rate | Base Rate | Final Rate | |

|---|---|---|---|

| Commune | 8.00% | 119% | 9.52% |

| Canton | 8.00% | 100% | 9.52% |

| Federal | 2.97% | 100% | 2.97% |

| Total | 20.49% |

This means that John can save 20.49% of the third-pillar contribution from his income tax bill. For example in the year 2021, where the maximum contribution is 6'883, this translates to a savings of 6'883 * 20.49% = 1'410. Assuming that John's marginal income tax rate stays the same and he makes the maximum contribution every year, he would save a total of 64k in income tax.

When making this decision, John can narrow down his choices into 2 questions:

- Should he open a third-pillar account?

- Should he open a savings or an brokerage account?

These questions lead to 4 scenarios:

| Savings Account | Investment Account | |

| Open Third Pillar | Scenario A | Scenario B |

| Don't open Third Pillar | Scenario C | Scenario D |

To make a fair comparison, I assume that John makes the same contribution to a similar savings or brokerage account in scenarios C and D.

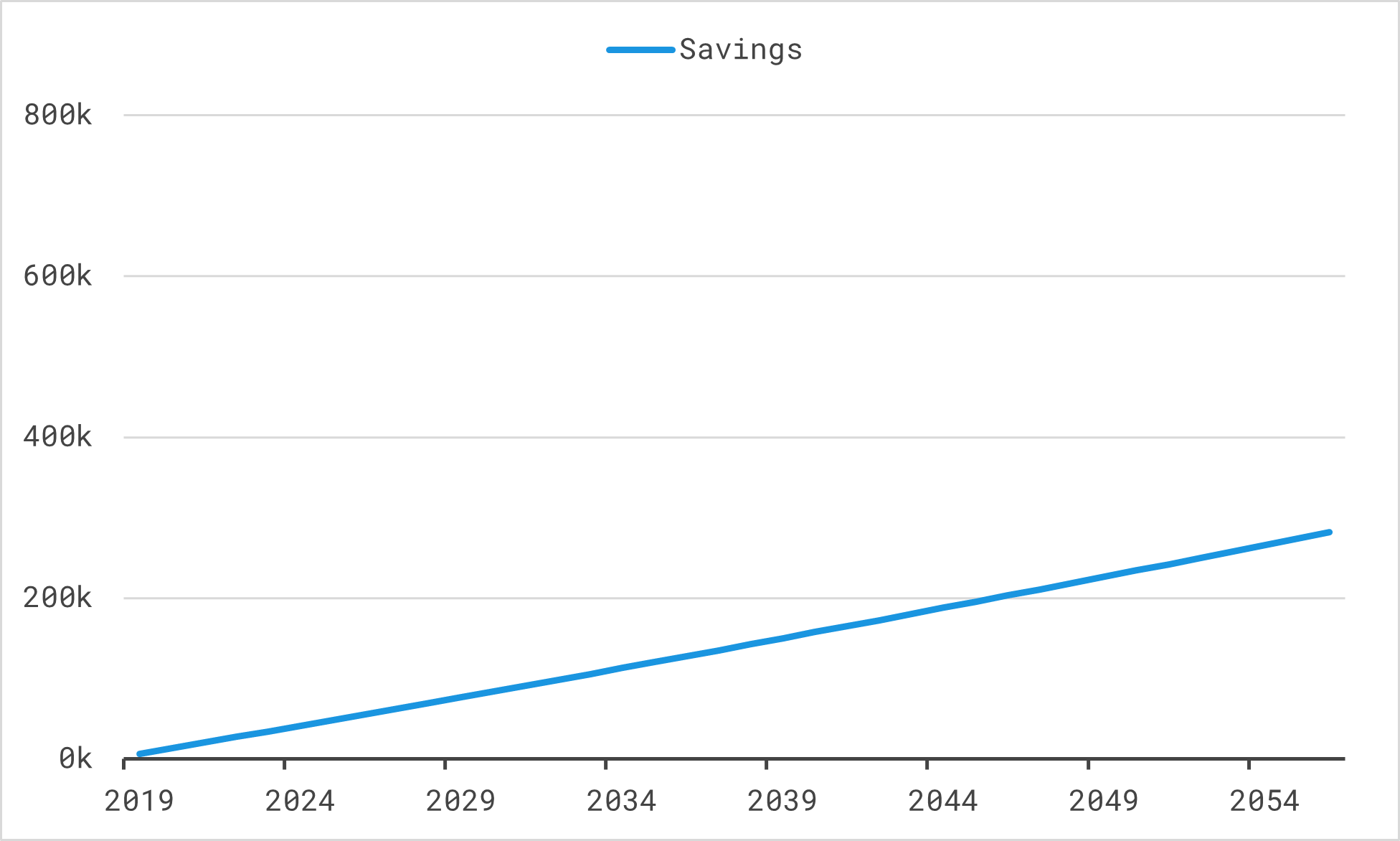

Scenario A: third-pillar savings account

In this scenario, the contribution is compounded with the typical interest rate for third-pillar savings account of 0.2%. Making the maximum forecasted contribution every year will result in a position of 282k. At the same time, John enjoyed the 64k income tax savings during this time. However, John would need to pay capital tax when liquidating his third-pillar assets before retirement. Withdrawing the amount 5 times would result in a capital tax bill of 13k.

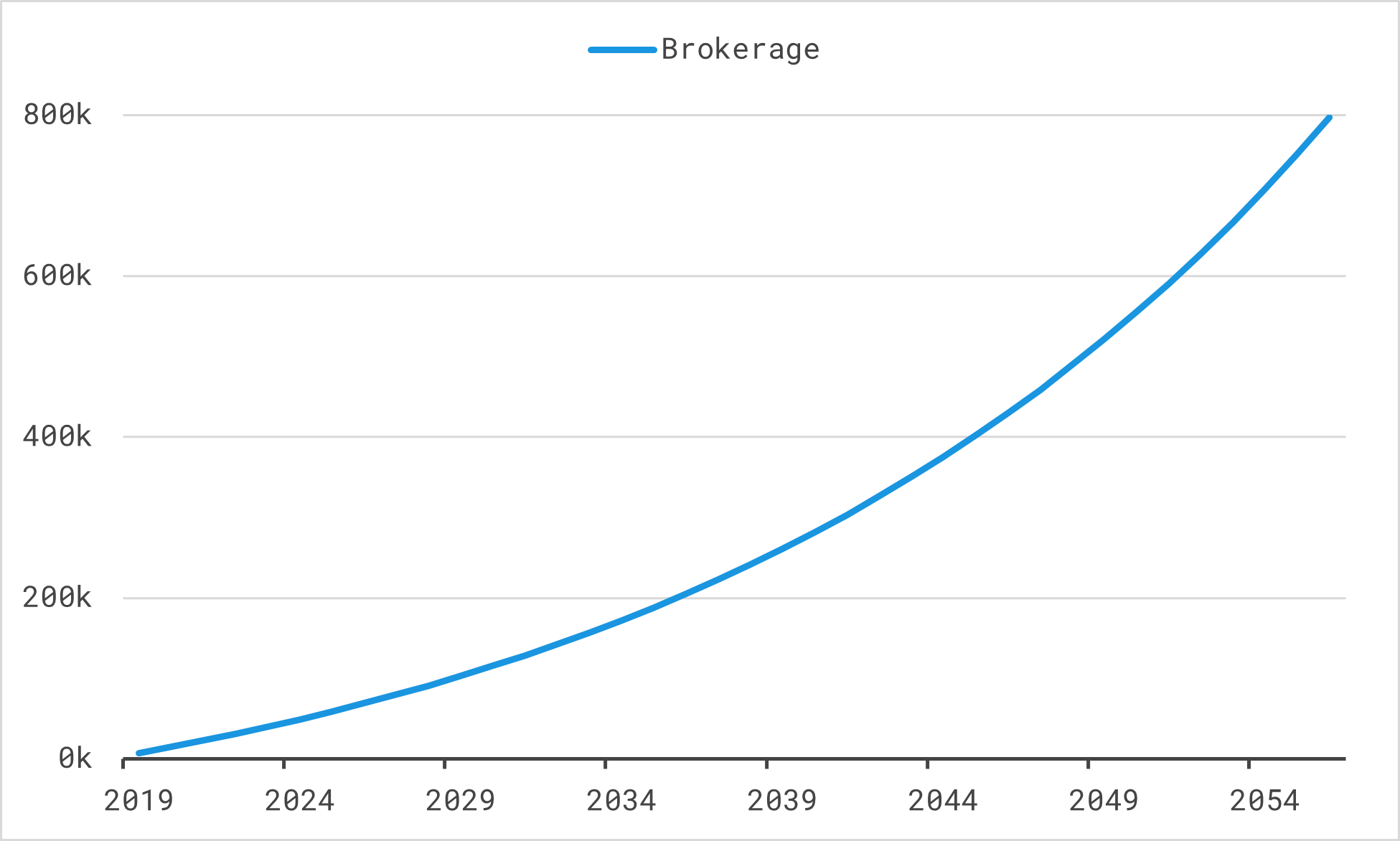

Scenario B: third pillar brokerage account

The contribution here is compounded with a conservative return of 5%. Even so, the powerful effect of compounding can be seen in the chart below which shows a total assets of 798k even when keeping the contribution the same The total income tax savings is also 64k as in scenario A because it only depends on the contribution made. However, because of the greater assets in the third-pillar account, this would result in higher capital tax at the end. Withdrawing the amount 5 times before retirement would produce a capital tax bill of 44k.

Scenario C: non third-pillar savings account

In this scenario, the same interest rate of 0.2% for third-pillar savings account is used in the calculation. This is a generous assumptions seeing that most bank accounts give zero interest and even charge a negative interest rate for large cash positions. The total assets would be 282k which is the same as in scenario A. However, John should consider the opportunity cost of not opening a third-pillar account here, which is the missing yearly income tax savings. On the other hand, John wouldn't need to pay capital tax at the end because there's no withdrawal from a third-pillar account.

Scenario D: non third-pillar brokerage account

Using the same assumption of 5% yearly returns used in scenario B, the total assets would be 798k. But John should also consider the opportunity cost of not opening a third-pillar account in this case. Concretely, as in scenario C, the possible yearly income tax savings of 64k should be deducted from the total assets and the avoidance of the capital tax added to it.

The table below shows the results for all four scenarios:

| Scenario | Assets | Income Tax Savings | Capital Tax Bill | Total |

|---|---|---|---|---|

| A | 282k | 64k | -13k | 333k |

| B | 798k | 64k | -44k | 818k |

| C | 282k | -64k | 13k | 231k |

| D | 798k | -64k | 44k | 778k |

There are some factors left out in these examples for the sake of simplicity that could result in greater returns for third-pillar accounts As John grows older, his income level is likely to rise and he might also get married, this would result in a greater yearly income tax savings as John gets into higher marginal income tax brackets. Furthermore, John should also take into account the time value of money, because savings earlier in life is more valuable than later since it can be directly reinvested somewhere else and generate return over time. On the other hand, if the long-term performance John's investment is greater than the 5% assumed here, the capital tax bill at the end would also be higher and could nominally equal the income tax savings.

To summarise, the examples above show that putting your assets in a third-pillar account is likely to produce a greater return because of the added tax benefits. Also, this example shows the power of compounding when comparing the returns generated by a savings and brokerage account. To risk sounding like a broken tape, I must again stress the importance of splitting your assets to multiple third-pillar accounts. Failing to do so will result in a large capital tax bill in the end that is likely to outweigh the tax benefits enjoyed over the years.

Download the Excel workbook used for the calculation here: