Third Pillar and the Power of Compounding Interest

If you have a 3A account, you might be familiar with the concept of staggered payouts. This is where 3A accounts are liquidated one-by-one each year starting with the fifth year prior to retirement. Since assets from liquidated 3A accounts are counted as income, staggered payouts allow you to save on taxes, even if 3A has a special tax bracket that's lower than the normal income tax.

There are many good articles about staggered payouts and the ideal number of 3A accounts, especially these from finpension:

I suggest reading the finpension articles first, since they would make the points here make much more sense. And I don't want to repeat what they've explained so well in their articles. One point that I don't really agree on in their article about the number of 3A accounts is on the low progression of taxes. I think they're being conservative when setting the upper bound of assets at CHF 100k. If you pay the maximum yearly 3A contribution and follow the full-equity strategy, there's a good chance that your assets will be greater than this amount. And that's the point where the progression kicks in most. I think the finpension article on staggered payout explains the progression better.

But even after researching quite extensively online, there is still a piece of information that I can't find. I've been paying into my first 3A account for a few years now. But when should I open my second and subsequent accounts. Ideally, I want the account to have similar amount of assets by retirement time, in order to spread the tax burden as much as possible. So, I did what most people with free time and a spreadsheet would do, I calculated the number of months I need to pay into each 3A account.

Firstly, there are some assumptions to be made:

- It's possible to postpone the 3A payout if you work past the official retirement age, but I'll keep it simple and assume that all accounts must be liquidated by the retirement age.

- The maximum 3A contribution gets adjusted every year. It is likely that the amount increases in the future to account for inflation. However, the same amount is assumed here for every year.

- Number of 3A accounts by retirement is five. If you're planning on liquidating your 2nd pillar, there's argument to have one 3A account less, but I'm not planning on doing that. And having more than five 3A accounts does not really give additional benefit since several accounts would need to be liquidated within the same year in that case.

- All 3A accounts are with the same financial institution and follow the same full-equity strategy.

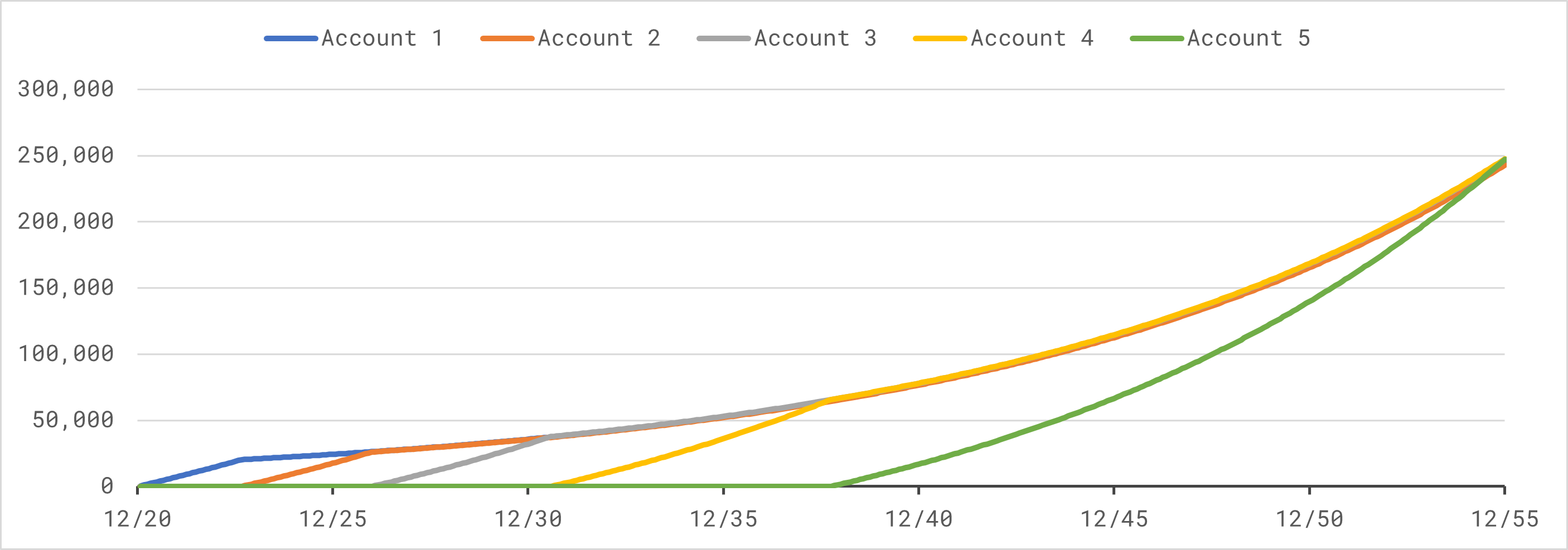

After creating the spreadsheet, I'm really blown away by the power of compounding interest. I know that the effect is strong, but I thought that I would have many years before needing to open additional 3A accounts. The knick on the graphs shows the time where the contribution into a particular account stops and the account is just growing with the investment performance. This shows that, since the first few accounts have the longest to grow, they need the least number of months with direct contribution. In fact, the chart shows that you should open a second 3A account after 32 months.

Extending on my spreadsheet calculation, I have created a simple web application which creates the 3A payment schedule here. This tool allows you to change the yearly contribution, assumed yearly performance and also the number of years until retirement. The number of accounts is kept at five for all calculations. Subsequently, the chart shows the development of the account balances and the table lists the duration of payment into each account.