The Opportunity Cost of Mortgage Amortization

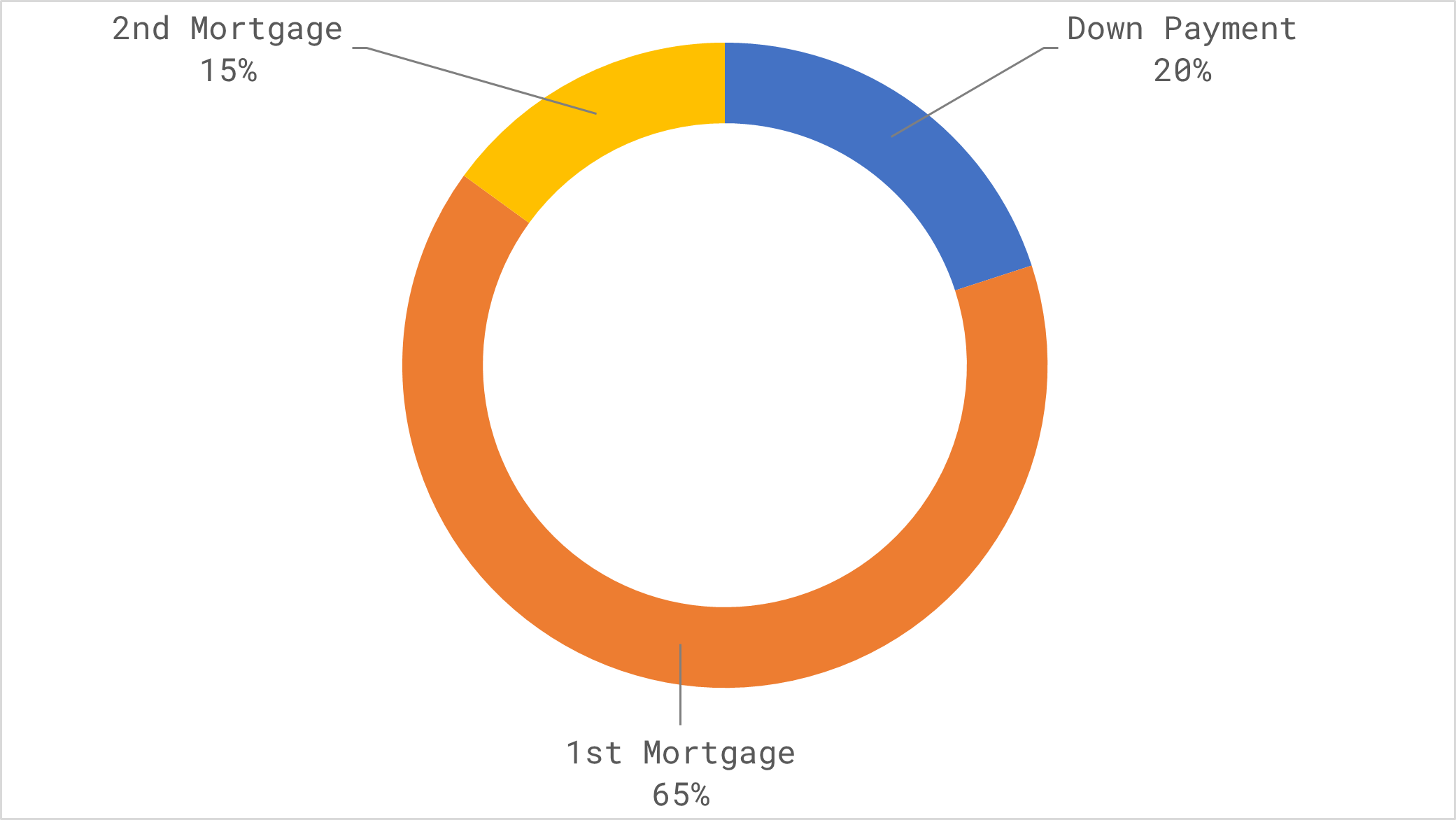

In the process of a property purchase, the topic of amortization will come up sooner or later. This jargony term basically means the process of repaying a mortgage debt. But to understand this, it would help to look at how a mortgage is usually structured. Typically, the financing of a property purchase in Switzerland is split like this:

The buyer needs to provide a down payment which is at least 20% of the purchase price. In some cases, you might need to provide a higher down payment (e.g., if the purchase price of the property is higher than the valuation of the bank, you would need to come up with the difference). But your mortgage advisor might discourage you from increasing your down payment, since this would reduce the interest payment the mortgage provider is receiving. They might make it sound like it's in your interest to pay the minimum down payment (since the rest can be saved or invested), and I would tend to agree, but it's still good to be a little skeptical.

Your mortgage provider, usually a bank, would then chip in with the 1st and 2nd mortgages. The SwissBanking association released a guideline on how the amortization of these mortgages should be handled (translated from German):

In the case of owner-occupied residential property, the mortgage debt should be amortized to 2/3 of the purchase price within 15 years. The amortization should be performed linearly starting no later than quarter-end 12 months after purchase.

This is where the differentiation between the 1st and 2nd mortgages come from. The first sentence basically means that the 2nd mortgage needs to be amortized within 15 years, leaving the 1st mortgage which is roughly 2/3 of the purchase price. The 1st mortgage can then be carried indefinitely without being amortized.

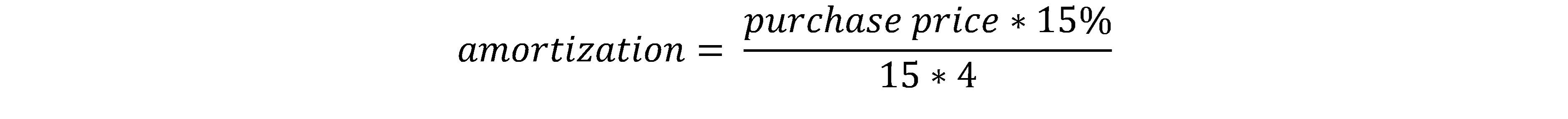

The second sentence then explains further how the amortization of the 2nd mortgage should take place. A linear amortization means that the amount of money to be paid back for each time period is the same for the first 15 years. The following formula shows the calculation of the quarterly amortization:

To change this to a monthly amortization calculation, the 4 in the denominator can be changed to 12. Thus, the rules regarding the amortization of the 2nd mortgage seems to be pretty clear. After 15 years, the 2nd mortgage would be completely paid back according to the rules above.

Would it also be possible to amortize at a higher rate? This is possible but not something the mortgage provider would suggest. The mortgage provider is usually very helpful during the process of purchasing a property and closing a mortgage deal because this means more business for them. But your incentive might not align completely with them on the topic of amortization, since they would receive interest payments the more you amortize. But this is certainly possible after a discussion with your mortgage provider. There might, however, be some rules in the mortgage contract regarding the maximum and timing of additional amortizations. For the sake of simplicity in this post, I'm assuming that the amortization is done constantly at the minimum rate stipulated by the formula above.

But what should the buyer do with the 1st mortgage? The fact that it isn't necessary to amortize the 1st mortgage begs the question whether it makes sense to do so. The answer to this question is, of course, not so straightforward as it involves opportunity costs and personal preferences.

Opportunity cost means the potential benefits that an individual misses out on when choosing one alternative over another. In this case, the opportunity cost of amortizing the 1st mortgage is the inability to use the money otherwise (e.g., for saving or investing). To quantify this opportunity cost, it could be helpful to look at 2 scenarios:

| Scenario 1 | Scenario 2 | |

|---|---|---|

| Year 1 - 15 | Amortize | Amortize |

| Year 15 - 80 | Amortize | Invest |

In both scenarios, the 2nd mortgage is amortized in the first 15 years until it's completely repaid as required by the guidelines. Then, for the subsequent years, the same amount of money would be used to amortize the 1st mortgage in Scenario 1 until it's also completely repaid. Conversely, the money would be invested into a broad-market index fund in Scenario 2.

The simulation of the scenarios uses the following assumptions:

- Property purchase price: CHF 1 million

- Down payment: CHF 200k

- 2nd mortgage: CHF 150k

- 1st mortgage: CHF 650k

- Interest rate: 1%

- Average yearly returns of index fund: 4%

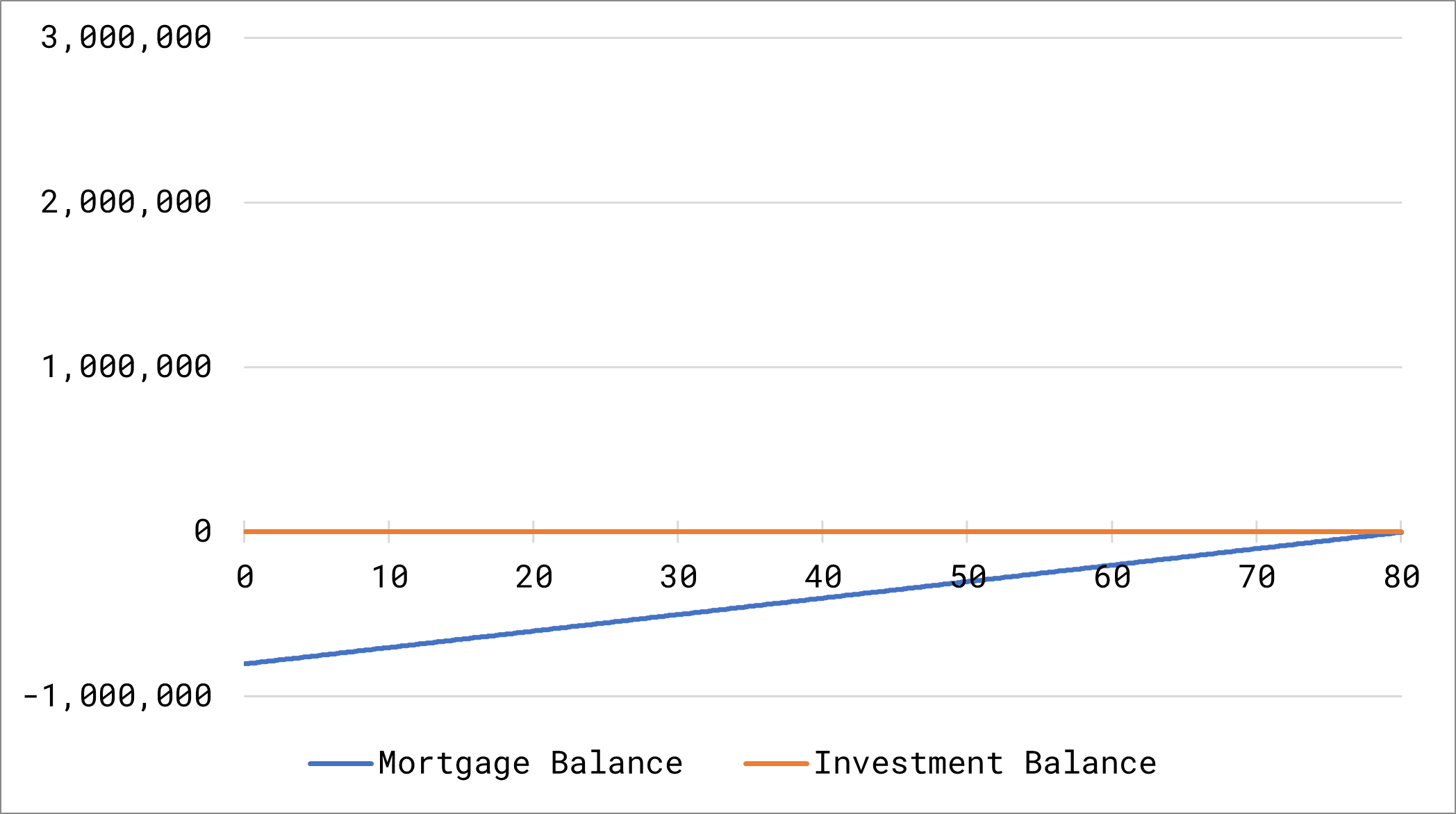

Scenario 1

In this scenario, the 1st and 2nd mortgage are amortized at the same rate until the property is fully paid by year 80! This probably won't happen in real life. You might move to another property within this time or repay the mortgage with one large payment once the balance is low enough, but let's assume this scenario for argument's sake.

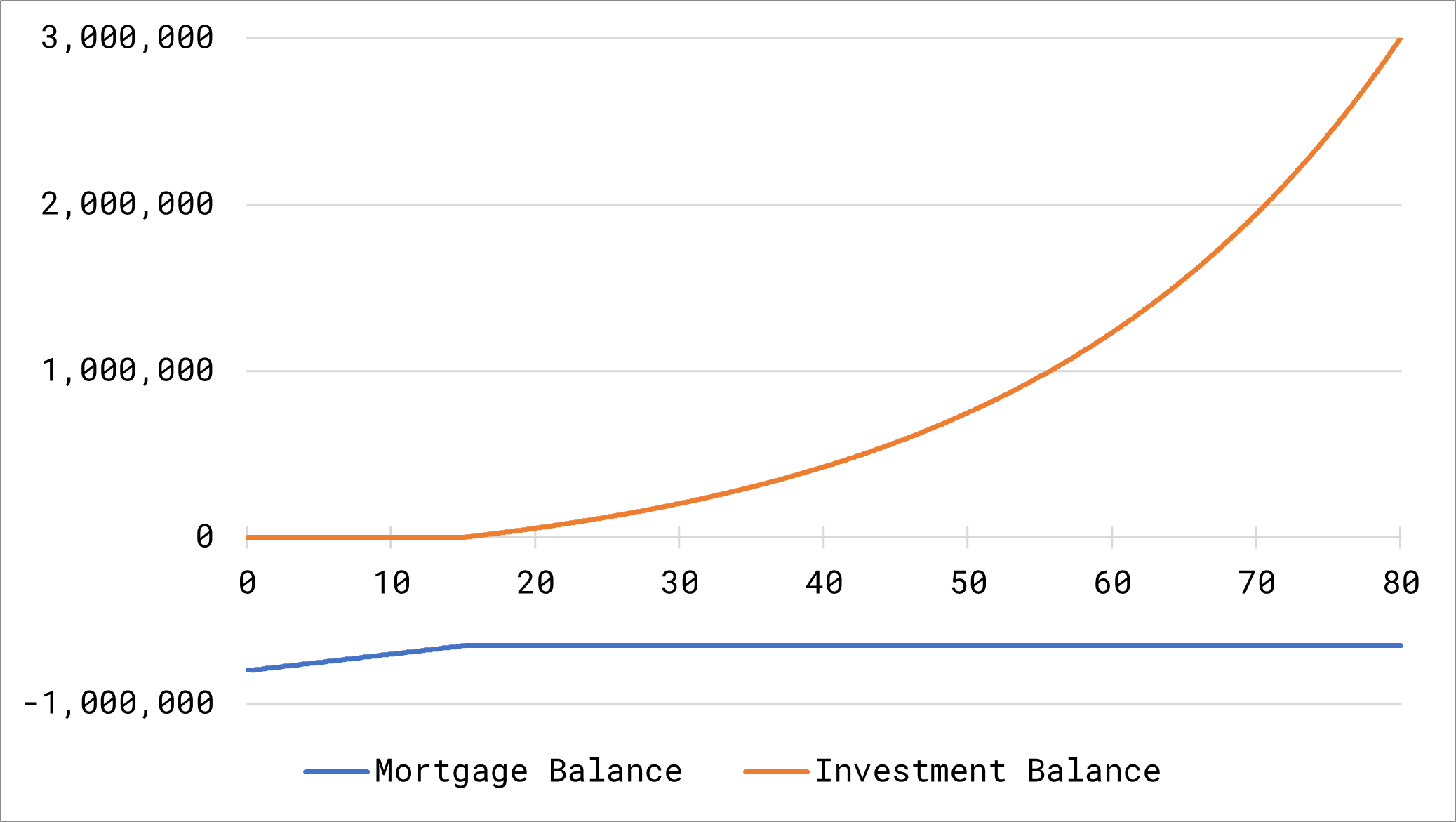

Scenario 2

In this case, the mortgage balance is kept constant after year 15 since the 1st mortgage is not being amortized. Instead, the money is put over time into an index fund which grows with compound interest until the end of the time period. This is assuming a constant return. In actuality, the movement of the investment balance would be more erratic. But since the investment horizon is rather long, we can simplify the simulation using an average return. The mortgage is still owed to the bank in this scenario. But the investment balance would allow the repayment of the mortgage while still leaving a profit.

Comparison

The difference in balance:

| Scenario 1 | Scenario 2 | |

|---|---|---|

| Mortgage Balance | 0 | -650k |

| Investment Balance | 0 | 3'003k |

| Additional Interest | 0 | -210k |

| Total | 0 | 2'143k |

The additional interest payment in scenario 2 comes from the fact that the mortgage balance is kept at a higher amount for longer and should be subtracted from the balance. However, the calculation in the table still shows that scenario 2 would result in a financially more advantageous situation. This potential gain is the opportunity cost of amortizing the 1st mortgage instead of investing the money.

In addition, another argument for not amortizing the 1st mortgage is because it could lead to a lower tax bill. This is a result of being able to deduct a higher mortgage interest payment from your income tax and a higher debt load from your wealth tax.

However, a strong argument for amortizing the 1st mortgage that shouldn't be ignored is the ease of mind that it might bring to the buyer. Investing in the stock market comes with the potential of gains, but also with the risk of losses at the same time. In a bear market, you could be faced with a situation that your mortgage debt has not been reduced and your investment has produced losses which results in a higher liability overall. The risk is reduced the longer the investment horizon is, but you still need to stomach it. But in any case, the quality of life that your ease of mind brings should not be discounted.

Furthermore, with the central banks currently increasing their reference interest rates to tamp inflation, we've seen increasing interest rates in the mortgage market too. If the interest rate of your mortgage is significantly higher than the one used in the example shown, your cost-benefit analysis might look very different. It is only advantageous to invest instead of amortizing if the potential return in the stock market is significantly higher than the interest rate of your mortgage. That's why it's important to assess your own personal situation.

Also, the scenarios shown here are two extreme examples. You also have the freedom of combining both strategies to various degrees. At the end of the day, the actual opportunity cost of amortizing a mortgage is very personal and you should pick the option with which you can sleep best at night.