Tax Deadlines in Switzerland

While I was a student and not having very much income, I must admit that I didn't really care about the details of the Swiss tax system. I just paid whenever the bills arrive, and never gave it too much thought. But then I graduated, started a full-time job and got married in the same year, and that resulted in quite a significant change in my and my wife's tax bill, especially because we need to report our combined income. I was always aware that there is an interest on late tax payments, but only focused on it after this point because the stakes were higher.

Cantonal and Communal Tax

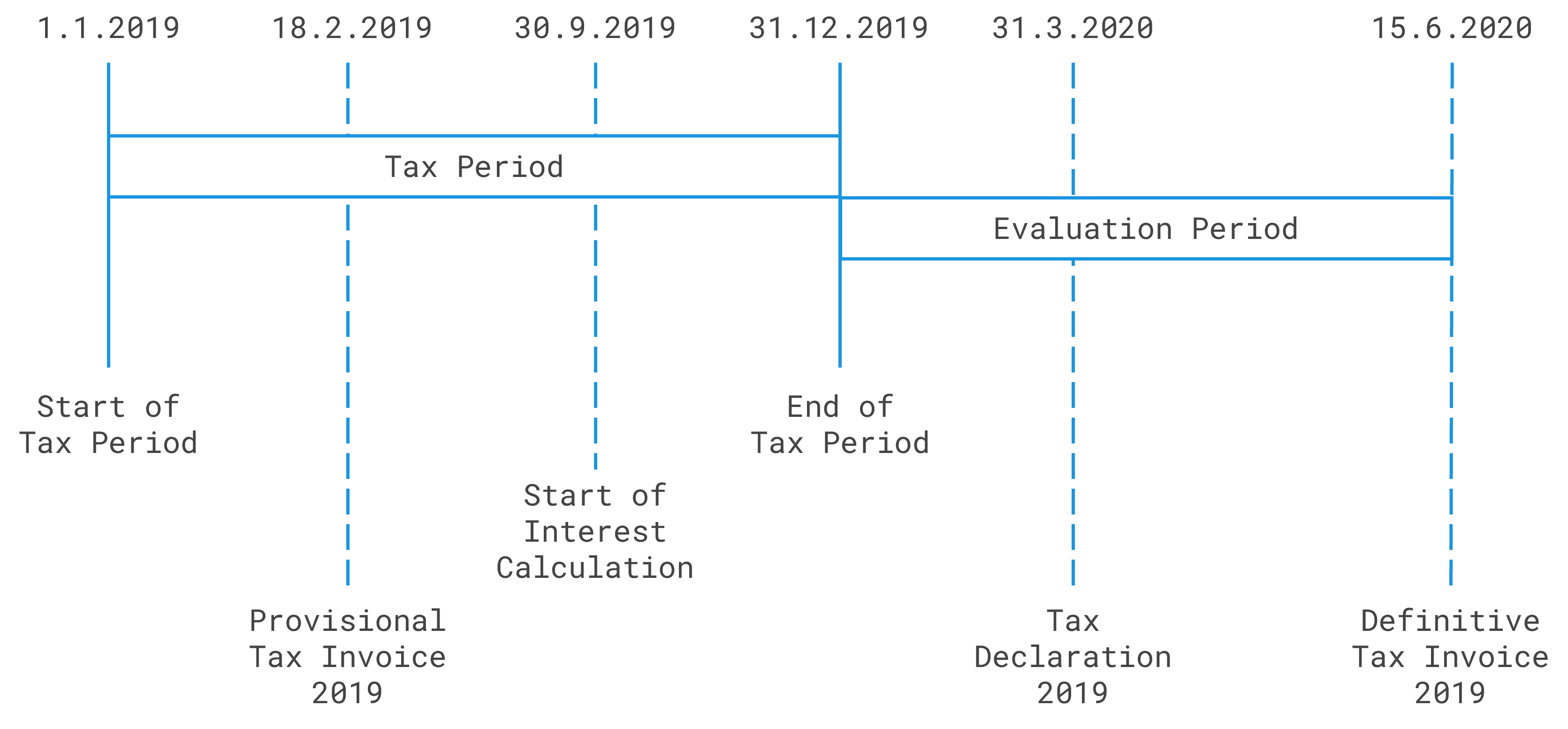

This is also known as Staats- und Gemeindesteuern in German. The important thing to note for the cantonal and communal tax is that the amount is owed on October 1 of the same year, instead of after submitting the tax declaration in the year after. The canton also starts charging interest (0.25% in Zurich as of 2020) on the amount owed starting October 1 of the taxation year. Considering that the definitive tax invoice is usually sent around August of the following year, there is a risk of paying interest on the amount owed for a whole year!

To avoid this, the canton sends a provisional tax invoice in February or March of the taxation year. The problem is, the provisional invoice is based on past tax payments. So if there is a significant change in financial situation, this would not be taken into account, and the tax might be underpaid. If I suspect that my actual tax bill would be higher, I would pay more than the stated amount on the provisional invoice, which is allowed by the rules.

But I would not significantly overpay on this tax just to be safe. There is the opportunity cost of not investing this extra money in another way. Therefore, I would perform a rough calculation of my tax bill for the year, and pay that amount before October 1 of the taxation year to minimise my interest charge. The hard part is predicting the variable income that might change during the year, but it's worth it since it could slightly lower my tax bill and I can reward myself to a dinner.

What I definitely avoid is late payments on the definitive tax invoice, as the interest on the amount owed is much higher at 4.5% as of 2020. But, there is a 30-day period to pay this invoice, within which time the interest would not be levied.

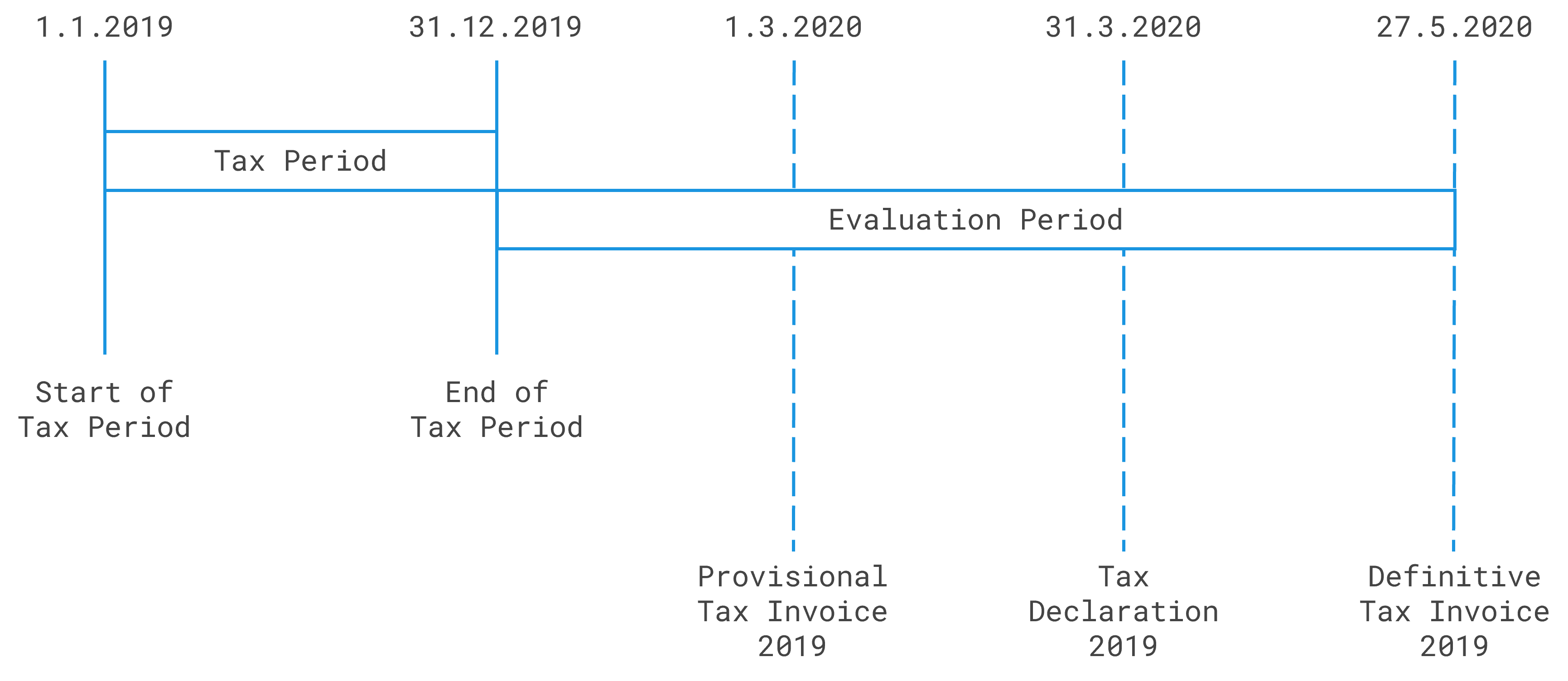

Federal Tax

This is also known as Direkte Bundessteuer in German. Unlike the tax on the cantonal and communal level, the federal tax has zero interest on the amount owed. Therefore, there is no real benefit in paying the actual amount owed before the deadline. You will still receive a provisional and definitive tax invoice, but this does not really make sense to me with the zero interest, why not just send the definitive tax invoice when the amount is known which will save work for everybody. The tax office will even try to return the extra money if you transfer more than the amount stated on the provisional tax invoice, even though you know for sure the definitive tax invoice would be higher. Long story short, I just pay the exact amount on the federal tax invoice (both provisional and definitive) as they come.

PS: the tax deadline charts are adapted from vzgv.ch