Portfolio Allocation

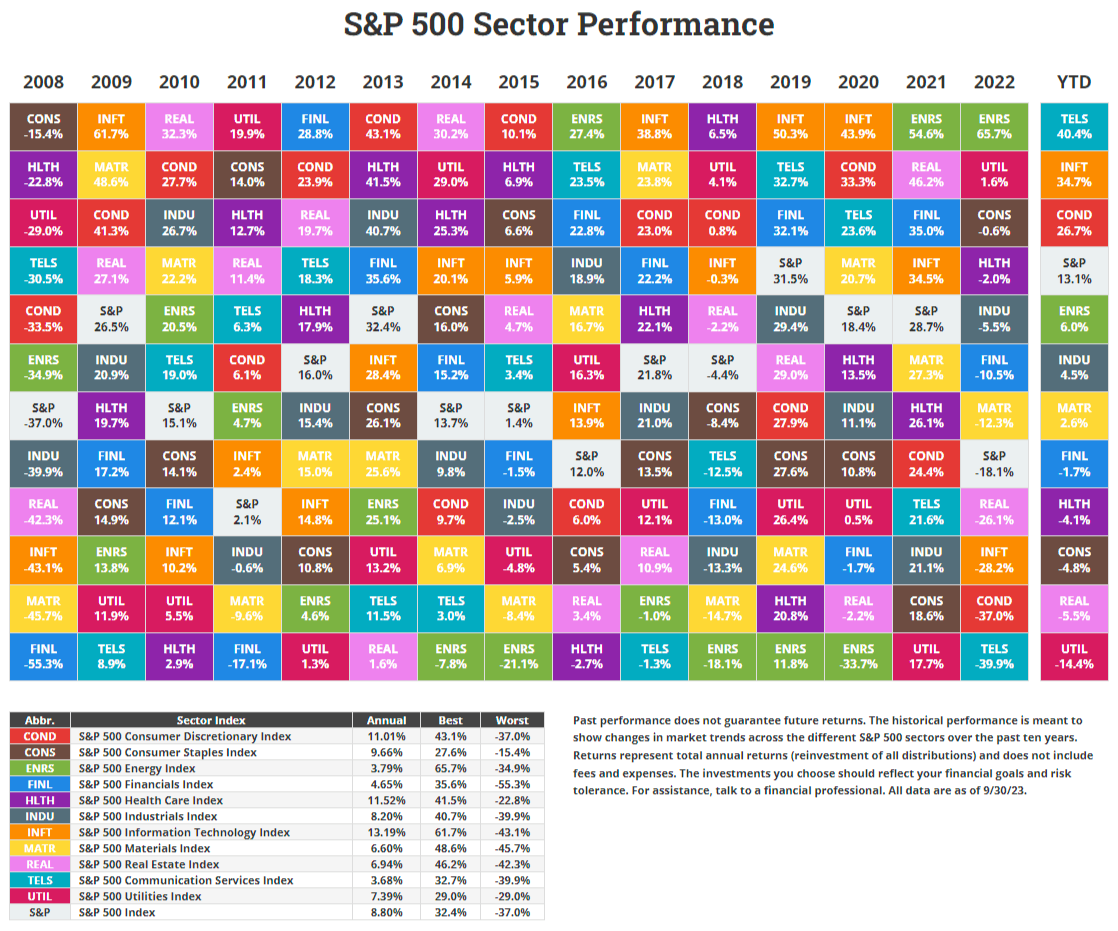

A colleague at work once showed a website called Novel Investor which greatly shows market performances. Ever since, I've frequently visited this site when reviewing my portfolio allocation. To keep things simple, I invest only in mutual funds or ETFs instead of individual stocks. But to satisfy my speculative urge, I position a small part of my portfolio in a sector that I think is oversold and might recover, sort of "buying-the-dip" in specific sectors. To that end, looking at the following table is very helpful:

Source: novelinvestor.com

Source: novelinvestor.comWhen the time comes to rebalance my portfolio, I refer to this table to identify the sector which have lagged in recent times and increase my exposure there. But as the above table shows very clearly, no sector enjoys a sustained outperformance. Thus, I think it's important to keep the main part of your portfolio diversified. Looking at the options above, investing in the S&P 500 Index as a whole instead of in any specific sector would result in less volatility for your portfolio.

In fact, even the S&P 500 Index is not diversified enough for me. The index excludes companies in the US with smaller market capitalisations and international stocks completely. Therefore, I invest the bulk of my portfolio in an ETF which replicates the FTSE Global All Cap Index and holds thousands of stocks from all over the world weighted by their market capitalisation.

I've stuck to this ETF for several years since I started investing regularly. But this is not to say that I haven't reviewed that decision ever since. Lately I thought about whether it makes sense to have any international exposure at all, seeing that the performance of the US stock market has been stronger compared to the rest of the world. However, my research shows that the markets act in a cycle and there are reasons to believe that that the rest of the world might outperform the US in the future:

- US and International Markets Have Moved in Cycles

- Making the Case for International Equity Allocations

Therefore, I've decided to stick with my main ETF for the time being which has a 60% exposure to the US market. I just consider the international allocation within that ETF as "buying-the-dip" in markets which are underperforming at the moment.

Novel Investor also has another table that shows the international stock market returns. This table is interesting to evaluate the home market bias, which exists everywhere but also especially in Switzerland. Even if I try to invest internationally in my personal account, I don't have the same flexibility when it comes to my pension accounts where the investment options do show a significant Swiss bias. Only in my pillar 3A accounts do I have the flexibility among my pensions accounts to create a custom strategy and counteract this bias. However, a look at the table below shows that the annualized return in the Swiss market is second highest at 6.06% just behind Denmark (would be interesting to see how much Novo Nordisk contributes to Denmark's performance). The US market is, however, not represented in the table below, which, if we take the S&P 500 Index from above as a proxy, has an annualised return of 8.80%. The Swiss home market bias might therefore not be the worst, but I will still aim to diversify my portfolio and allocate internationally.

Source: novelinvestor.com

Source: novelinvestor.com